doordash quarterly taxes reddit

FICA stands for Federal Income Insurance Contributions Act. A 1099-NEC form summarizes Dashers earnings as independent contractors in the US.

A Beginner S Guide To Filing Doordash Taxes 4 Steps

If you made 5000 in Q1 you should send in a Q1 payment voucher of 765 5000 x 0153.

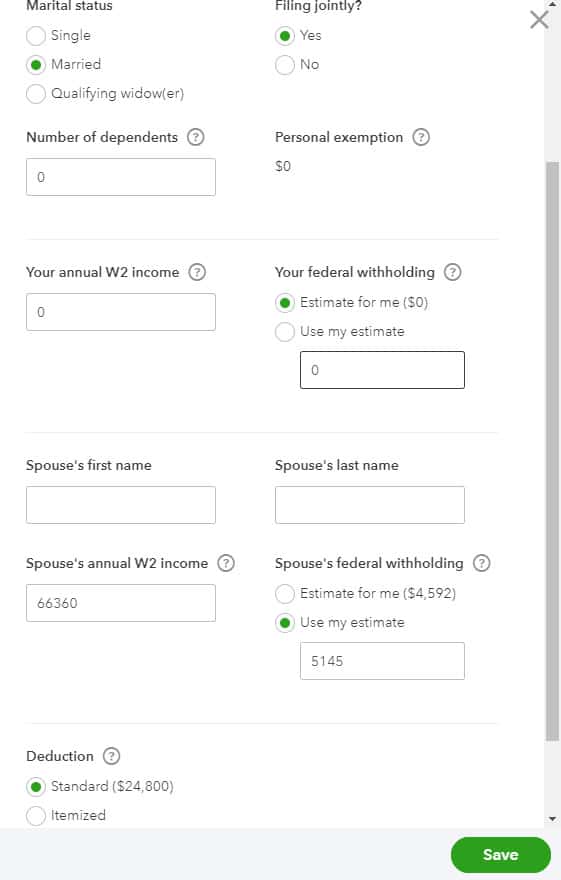

. This should be an easy fraction to compute and cover you unless you start earning more than 4000 per quarter. My Door Dash Spreadsheet Finance Throttle. What are the quarterly taxes for grubhub doordash uber eats delivery drivers.

Im new to this independent contractor business and come from the corporate world so not familiar with the concept of quarterly taxes. You can pay online with a bank account or card and dont need to file any forms. A DoorDash driver has lost her job after a video of her confronting a customer went viral on Reddit.

Thats your business income. I would put aside like 25-30 for taxes. Add up all your Doordash Grubhub Uber Eats Instacart and other gig economy income.

The federal tax rate is sitting at 153 as of 2021 and the IRS deducts 0575 per mile. Thats 12 for income tax and 1530 in self-employment tax. Then I adjust it at end of year to more or less miles as needed.

Last day to file taxes. 4d edited 4d. Try the App Get the best DoorDash experience with live order tracking.

Tax Forms to Use When Filing DoorDash Taxes. A most excellent meme from uPuzzleheaded-Dog-940. Theyll probably send you a check for 1 that cost them.

I have found that when I calculate my quarterly taxes it always falls between 19 and 23 of my GROSS income for that quarter. Last year on 57000 income betweeen DoorDash and postmates I paid 390 in taxes. I save about 25 of my DD earnings in a separate account.

And then doordash customer service is shit. Dasher 1 year Theres no fee at all unless you owe over 1000 for a second year. The Doordash Reddit is full of spot-on memes.

Subtract 56 cents per mile that you recorded on your mileage log 2021 tax year 585 for 2022. Doordash taxes reddit 2021 home artista doordash taxes reddit 2021. Whether you work as a DoorDash driver part-time or full-time you need to file your taxes correctly.

My understanding is that 1099 individuals who anticipate having to pay over 1000 in taxes at the end of the year must pay quarterly taxes in addition to the year-end tax process. Check out our Top Deductions for DoorDash and our Guide to Quarterly Taxes. Thats what I use as a fast easy estimate of my taxable income.

March 31 -- E-File 1099-K forms with the IRS via FIRE. Why should couriers with Grubhub Doordash Uber Eats Postmates and others even pay attention to quarterly tax estimates. I personally keep a mile log in notes on my phone.

What are the quarterly taxes for grubhub doordash uber eats delivery drivers. Now multiply your miles times 58 cents for 2019 575 cents for 2020. Subtract that total from your earnings so in that example if you earned 10000 subtracting the 5800 leaves you with 4200.

And 10000 in expenses reduces taxes by 2730. If you dont pay the quarterly estimated taxes you will be fined a small penalty when you file your taxes by April 15th. The taxes might be a bit more complicated but there is an arrangement that gives you so much freedom as a DoorDash driver.

Your late fee is gonna be like 10 if that lol. Ended up only owing IRS about 250 so essentially had 1250 in tax returns which is about my usual amount. We hope you found some helpful advice in some of our favorite DD tips from Reddit.

DoorDash drivers are expected to file taxes each year like all independent contractors. The process of figuring out your DoorDash 1099 taxes can feel overwhelming from expense tracking to knowing when your quarterly taxes are due. Last year made 7k from DD and saved about 1500 hundred for tax purposes.

What are the quarterly taxes for grubhub doordash uber eats delivery drivers. Make quarterly payments of 15 of your net income. Your FICA taxes cover Social Security and Medicare taxes 62 for Social Security and 145 for Medicare.

If you do this full time and are actually making money at it you probably want to pay attention to it. Every mile driven on the job saves you about eight cents in taxes. The tax rate can potentially change every year or every few years so keep an eye out for updates from the IRS tax laws for self-employed contractors.

Ended up only owing IRS about 250 so essentially had 1250 in tax returns which is about my usual amount. DoorDash will send you tax form 1099-NEC if you earn more than 600. Dude if you only made 1000 all year I wouldnt even mess with quarterly taxes.

Can I collect doordash settlement without getting fired by doordash. This calculator will have you do this. To pay the estimated taxes for Q1 you must total your DoorDash income for the quarter and multiply your income by 153.

You maybe dont need to. All I do each quarter is send the IRS 20 from my GROSS earnings for that quarter and call it good. So knowing that I quit wasting my time calculating and just send the IRS 20 of the gross income each quarter.

I dont want to go down the rabbit hole too much about taxes. Top 10 news about Doordash Driver Tips Reddit of the week. You can also enter the average cost of gas per gallon and your cars average miles per gallon.

Please note that DoorDash will typically send. If you drive your car for your deliveries every mile is worth 56 cents off your taxable income the standard mileage rate for the 2021 tax year it bumps up to 585 per mile in 2022. The bill though is a lot steeper for independent contractors.

Its provided to you and the IRS as well as some US states if you earn 600 or more in 2021. The forms are filed with the US. Everlance has partnered with DoorDash to help Dashers.

Everyone is going to be different. I have a w2 job and DD is just a side thing. All the light were on and had really nice Ferrari and BMW in the front.

If youre a Dasher youll need this form to file your taxes. Doordash quarterly taxes reddit Sunday April 24 2022 Edit. Technically both employees and independent contractors are on the hook for these.

If you made less than 600 you are still responsible for paying taxes and filling out a 1099-NEC. For example 10000 miles is 5800. This way i decide how many miles i went a day if you get my drift.

Internal Revenue Service IRS and if required state tax departments. IRS will come knocking if you dont know what to do. So all in all the total was about 118 dollars - 10 in gas.

Doordash Taxes 2022 A Complete Guide For Dashers By A Dasher The rule of thumb is to set aside 30 to 40 of your taxable income and send it to the IRS in quarterly payments. Drivers who make more than 20000 with more than 200 transactions will have to file form 1099-K.

How Do I Calculate Quarterly Taxes Estimates For Doordash Grubhub Uber Eats Postmates And Other Gig Work Entrecourier

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

New Tax Megathread Because The Other Is Archived Talk Taxes Only Here R Doordash

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

How Do I Calculate Quarterly Taxes Estimates For Doordash Grubhub Uber Eats Postmates And Other Gig Work Entrecourier

Quarterly Tax Payment For Doordash Grubhub Drivers Entrecourier

Makenzie Way 2020 Graduate Of Penn Law Reached Out To Mike Sims President Of Barbri To Get The Answers To H Organizational App Phone Deals Wedding Planning

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

My Door Dash Spreadsheet Finance Throttle

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

1040es Question About Expected Income Vs Expected Wages R Tax

Paying Taxes In 2021 As A Doordash Driver Finance Throttle

How Does Doordash Do Taxes Taxestalk Net

How To File Taxes As An Independent Contractors H R Block

A Beginner S Guide To Filing Doordash Taxes 4 Steps

The Best Guide To Paying Quarterly Taxes Updated For 2021 Quarterly Taxes Estimated Tax Payments Tax Payment